Capital Bloom is a brokerage firm specializing in direct access to regulated lenders for leveraging stock and crypto loans. We provide transparent and straightforward liquidity solutions to retail and corporate clients.

Introduction

What is a public stock and crypto collateral Loan?

A public stock and crypto collateral loan, is a way to borrow money or crypto using publicly traded stocks as collateral.

What are the benefits of a public stock or crypto collateral Loan?

Consider the deterrent of the capital gains tax if you sell your stock. This product gives you access to tax-free funds from an asset that otherwise would be sitting underutilized, while most importantly, not selling and keeping your investment secure for future upside.

Value Proposition

As a leading stock and crypto loan brokerage, we pride ourselves on our speed and ability to solve complex structures. We service North America and international markets. We prioritize building long-term client relationships by offering competitive rates and excellent service.

Versatility

More Value

Competitive Pricing

Efficiency

Security

Unlock Funds Hassle – Free

Your Path to Financial Freedom

We believe in empowering you financially, allowing you to decide how best to utilize the funds.

Stock & Crypto Collateral Loans

A collateralized stock or crypto loan represents a transaction in which a qualified borrower pledges a block of a publicly traded stock or cryptocurrency as collateral for a loan. The borrower then makes monthly interest payments over the life of the loan, with one final bullet payment at the end of the loan term.

Title Transfer vs. Non-Title Transfer

With our non-title transfer loans, you maintain ownership of your shares. Title transfer loans involve transferring the title, which typically results in more favorable terms.

Non-Recourse

Should a borrower default on interest or principal, the lender takes full possession of the pledged securities, and the borrower retains loan proceeds without recourse to the borrower’s other assets. Credit ratings, adjusted earnings, leverage ratios or other creditworthiness metrics of a potential borrower are not considered.

Retain Upside Value

Borrower retains all future value upside and potential appreciation of the asset.

Funds & Currency

Loan Proceeds will be directly wired to the borrower, and there are no restrictions on their use. Additionally, the funds can be issued in most currencies.

Tax Benefits

In most jurisdictions, loan proceeds are not taxed. This allows the borrower to avoid capital gains taxes by borrowing against your asset rather than selling, all while ensuring you benefit from any future appreciation.

Dividends

During the loan term, borrower receives credit for dividends paid on the securities.

Stock & Crypto Loan Overview. Borrower Eligibility

These loans provide flexible terms with possible options for prepayment and refinancing. They also have no credit requirements and protect borrowers’ other assets in case of default.

LOAN TERMS

Terms offered are based on assets daily liquidity volume.

• Loan term: 1–5 years (extendable to 10)

• Annual interest: 1.99% – 6%

• Loan-to-Value (LTV): 40% – 70%

• Fast processing:

• Underwriting: 1–3 days

• Funding: 7–14 days

• No upfront application fees

• 3% Origination fee deducted from loan proceeds

• Principal repaid at maturity

• Non-recourse: no impact on credit in case of default

• No restrictions on how funds are used

BORROWER & COLLATERAL REQUIREMENTS

Securities must be:

• Publicly traded on major exchanges

• Free from restrictions

• Held electronically and transferrable

• Borrower must fully own the pledged shares

• Collateral held by lender or its designated Broker Dealer

• Borrower remains beneficiary of any dividends during loan term

• Credit scores, earnings, or leverage ratios are not considered

Lender Process

Application Process

& Compliance

At Capital Bloom, we assist you through the whole process with lender communications and negotiations. Ensuring you have the best possible outcome and service at every step.

Regulatory Standards

• Our lenders strictly adhere to AML regulations and securities laws.

• Client confidentiality maintained.

01 – Schedule an Introduction Discovery Meeting

We begin with a formal meeting to discuss our product in detail and address any questions you may have. This allows us to fully understand your needs so we can obtain preliminary terms from a lender that aligns with your objectives.

02 – Lender Meeting

We will then schedule an introductory meeting directly with the lender. This gives you an opportunity to learn how the lender operates.

03 – Terms

The lender will provide a term sheet for the asset for your review. If you decide to proceed, you’ll return a signed term sheet.

04 – Master Agreement

A contract will be issued, where we can assist with possible further negotiations. Once finalized, you’ll sign and submit the agreement along with your KYC (Know Your Customer) documentation.

05 – Funding

A loan is then issued to the asset owner, with financial assets pledged as collateral.

06 – Financing & Collateral Loan

Upon full repayment of the loan, all collateralized assets are returned to you, allowing you to retain 100% of the investment upside.

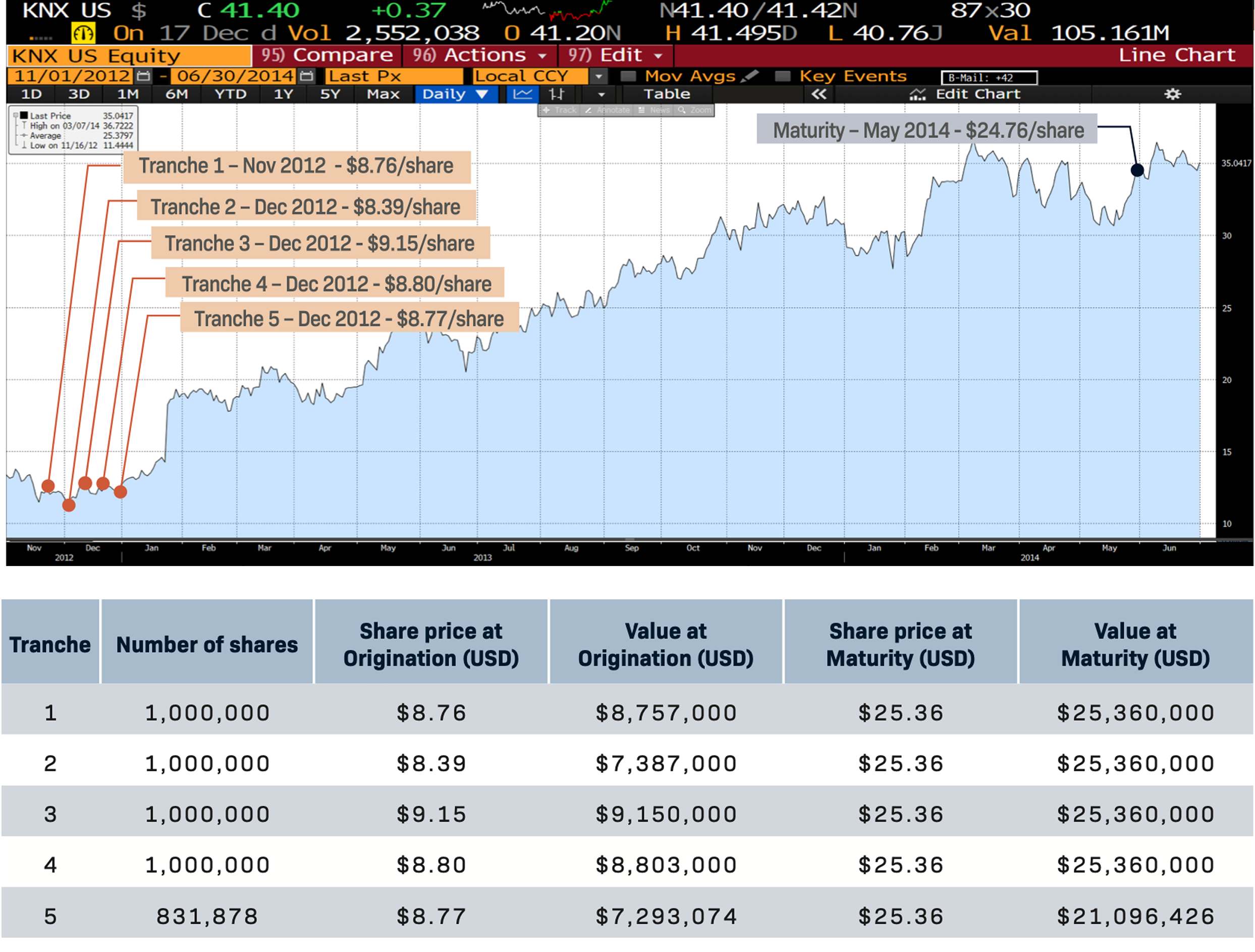

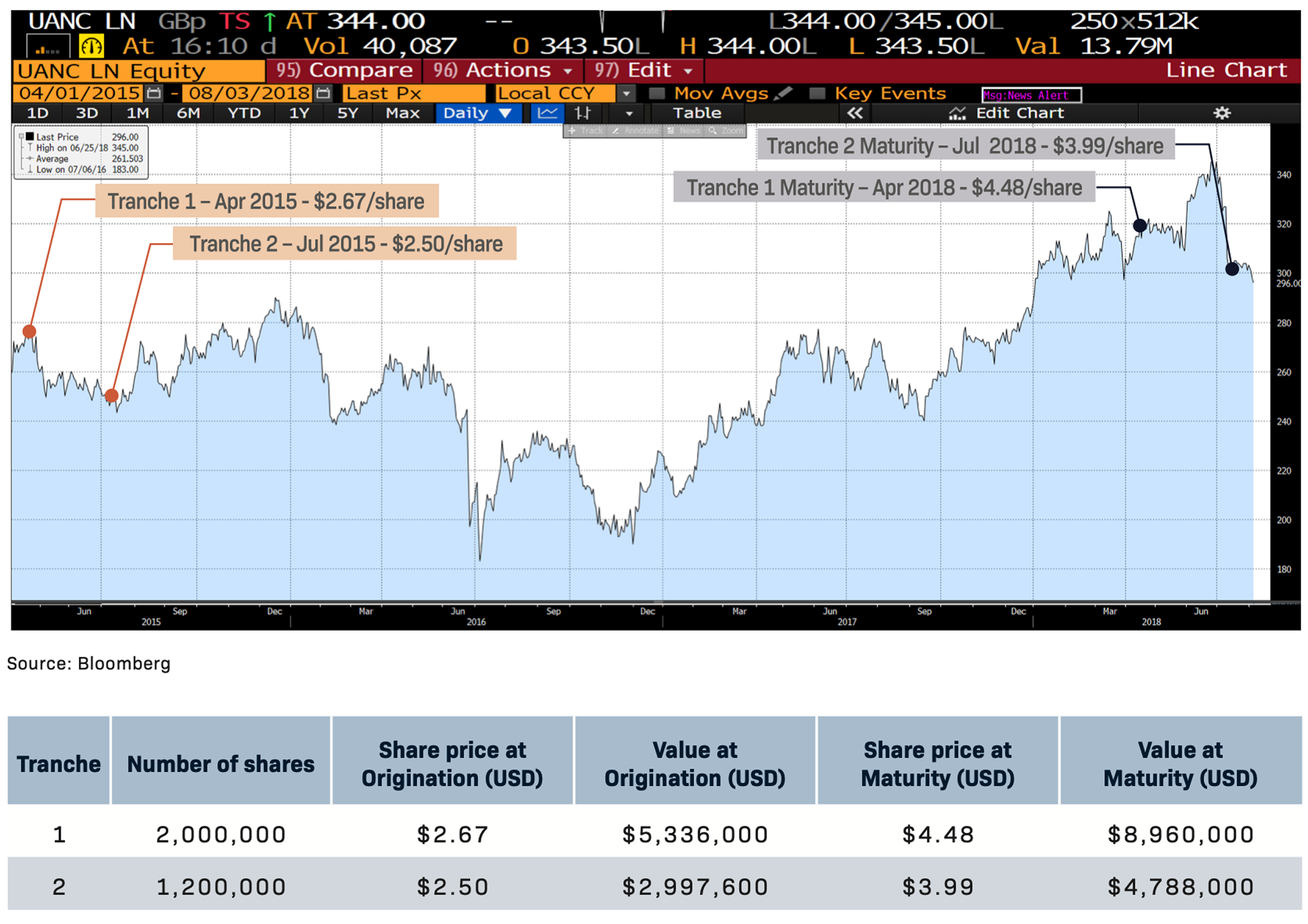

Case Studies

Our Projects

About Us

Meet Our Team

Get in Touch

- Email: [email protected]

Fill out form

Fill out Form

Schedule a meeting below

- Schedule Meeting